Table of Content

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. We are an independent, advertising-supported comparison service. For nearly two decades, she has been helping consumers learn how insurance laws, data, trends and coverages affect them.

We analyzed rates for top homeowner insurance companies and found the national average to be $1,854 (for dwelling coverage of $300,000). The top five cheapest companies are well below the national average. USAA is the best low-cost homeowners insurance option for veterans and active service members and their families.

Most common home insurance risks in North Dakota: tornadoes and snow

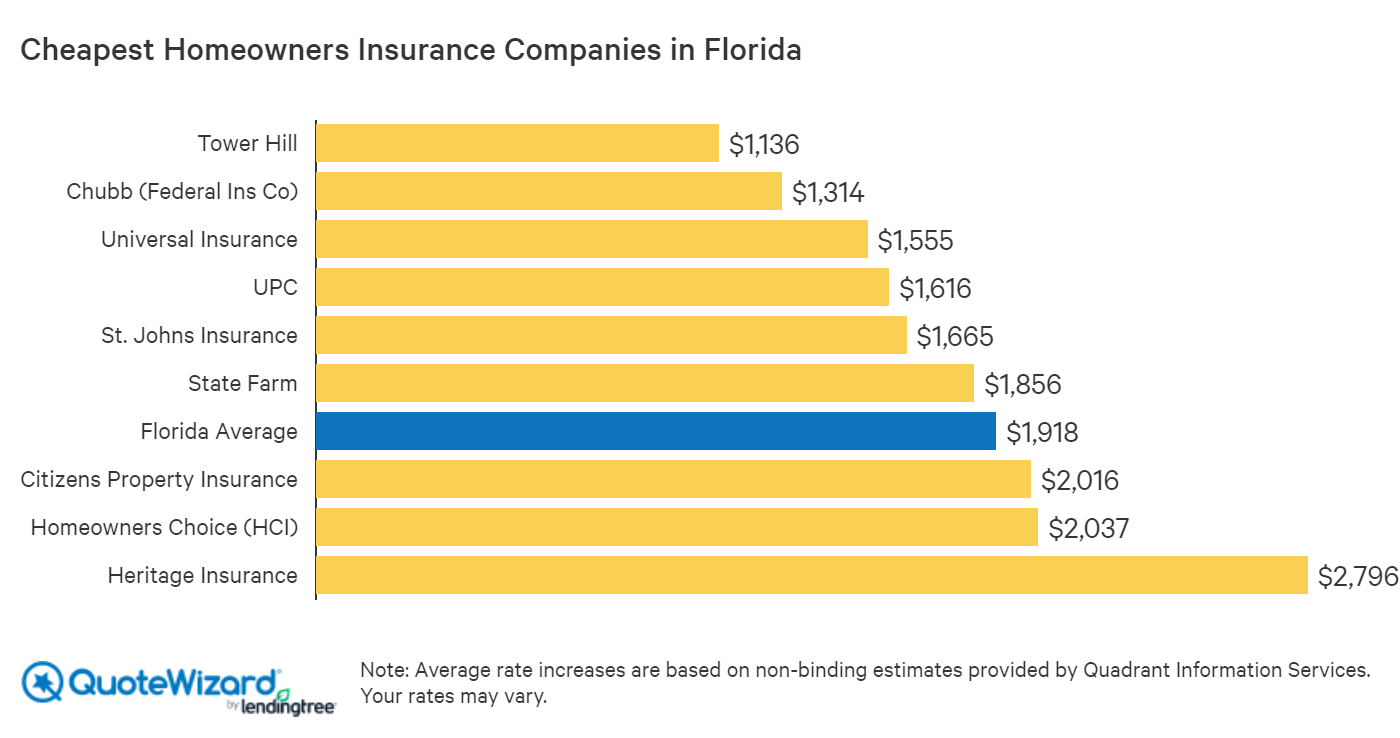

For each state average, we collected quotes based on the median home age and value for the state. For example, our sample home in Florida was built in 1986 and insured to a value of $215,300. Meanwhile, our sample New York home was built in 1957 and insured for $313,700. We used median home values to approximate the replacement cost in each state.

California, Maryland and Massachusetts don’t allow insurance companies to use credit as a factor in homeowners insurance rates. If you’re planning on replacing your roof, you might want to speak with your insurance agent first. Certain types of roofing materials can result in lower home insurance premiums, depending on the insurer. For example, impact-resistant roofing shingles that are designed to resist damage from hail, high winds and flying debris may lead to better home insurance rates.

Sint Jacobiparochie to Chile

Other well-rated companies that offer cheap homeowners insurance include State Farm and Allstate. This company sells homeowners insurance only to active military, veterans and their families. In most states, USAA covers your belongings on a “replacement cost” basis.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

Wondering who has the cheapest home insurance?

Their approach is as refreshing as … well … a glass of lemonade. If you’re looking for one of the best bangs for your homeowners insurance buck, State Farm provides comprehensive protections for reasonable premiums. If you haven’t filed a claim within a certain period of time — usually three to five years, although it varies by company — you could save money on home insurance. The homeowners also have a $1,000 deductible and a separate wind and hail deductible . Depending on your dwelling coverage limit, you may need to have a higher deductible. Information provided on Forbes Advisor is for educational purposes only.

Your home’s market value is based on its worth when selling or buying it. The insurance value is the amount of coverage you’ll need to rebuild the house if it’s destroyed by a problem, such as a house fire. The insurance amount could be more or less than your home’s real estate market value.

Maintain good credit

If you are a first-time homebuyer, you may be happy to know that several companies offer new purchase or first-time buyer discounts. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Also, when you determine your insurance amount, you don’t include your land value.

The proverbial new kid on the block, Lemonade is looking to shake up the insurance industry with a transparent approach that puts customers in control of their coverages. With easy-to-understand language and reasonably priced premiums, they’re our top pick for affordable homeowners insurance. They’ve got almost a century of experience protecting homes, and with their track record, it's no wonder they’re one of the most popular insurance providers in the country. Their prices are affordable, their protections are robust, and their customer service is stellar. Allstate offers multiple discounts to help you save on your policy including discounts for bundling and claim-free years. Based on our research, these eight companies offer competitive premiums for homeowners with average credit, based on 2022 rates pulled from Quadrant Information Services.

Home insurance in North Dakota costs an average of $1,475 per year, but cost is only one factor when choosing the best policy for you. We collected thousands of quotes across hundreds of ZIP codes from North Dakota's top home insurers to help you compare the best home insurance for cost, reliability and customer satisfaction. Depending on which company you choose, your rates could go even lower still — if you go with Allstate, for example, your home insurance premium could be as low as $272 a year! Even more surprisingly, Honolulu has some of the cheapest home insurance in the state, with Ewa Beach and Royal Kunia not far behind. As always, it’s worth shopping around and gathering quotes to find the best rate possible.

You can purchase coverage for an average of $978 per year, which is 26% less than the average cost of home insurance in the state. Flood damage is not covered by a standard homeowners insurance policy. For most homeowners, flood insurance is optional, but if you live in a flood hazard zone, your mortgage company may require it. On the other hand, the following 10 states have the most expensive average annual homeowners insurance premiums. If you live in one of these states, we highly recommend using our shopping guide to make sure you can find the best price with the right coverage. Travelers has some of the most affordable homeowners insurance policies and offers a variety of deductible options, which can help decrease your premium.

Overall, home insurance in Minnesota is 31% higher than the national average of $1,516. Homeowners insurance in Georgia costs an average of $1,317 per year or $110 per month. However, the average price ranges up to $861 per year depending on where you live. Because wind is listed on your policy notice page as a peril that covers wind damage from both tornadoes and hurricanes. If you have less-than-perfect credit, it can be somewhat of a toss-up as far as which company offers you the best prices. Drivers with "fair" credit pay about 8% less with Allstate than Trexis, but those whose credit is considered "poor" have it flipped -- saving around 9% per month with Trexis.

If you can, avoid rate hikes by paying cash for home repairs and filing a claim only when absolutely necessary. Deductible, you’ll generally pay less for your homeowners insurance. A deductible is the amount of a claim you cover yourself before the insurance company pays out.

No comments:

Post a Comment